Introduction

Welcome to a burning discussion that’s not just lighting up dinner table talks but also sparking serious debate among investors. Yes, we’re talking about the Green New Deal and its potential impact on the financial dynamics of alternative lending to drilling companies. With environmental policies gaining momentum, how will the lending landscape shift over the next half-decade? Stick around, because this topic is as hot as they come!

The Green New Deal: A Brief Overview

In simple terms, the Green New Deal is a proposal to address climate change while creating new jobs. Born in the halls of the U.S. Congress, this ambitious plan aims to transition America to clean, renewable energy within a decade. The idea is pretty grand, isn’t it? But it’s not just about planting trees; the Green New Deal has some serious economic implications, too. In its mission to decarbonize the American economy, it targets multiple industries, with the drilling sector being one of them.

Alternative Lenders: Who Are They?

So, you’ve probably heard of banks, but how much do you know about alternative lenders? These are entities that offer loans, but they’re not banks. They range from crowdfunding platforms to venture capital firms. These guys love niches; they fill the gaps traditional banks don’t cover, often focusing on high-risk, high-reward ventures. And yeah, drilling companies have often been on their radar.

Drilling Companies and the Energy Sector

Role in the Economy:

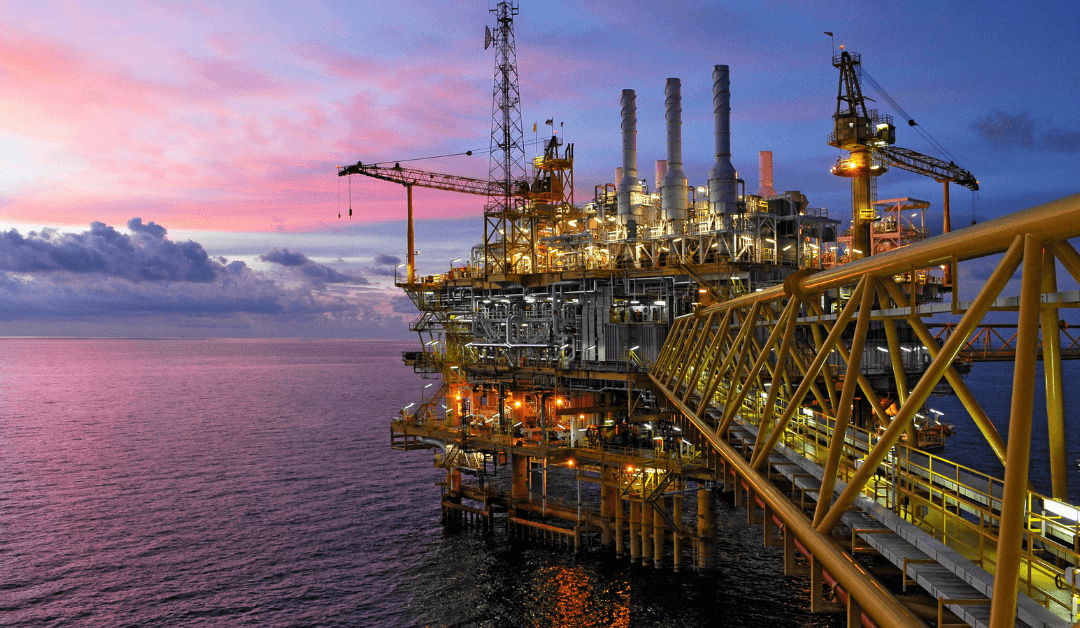

Drilling companies, often operating in the oil and gas sector, have long been the backbone of the U.S. energy market. They’ve contributed significantly to the GDP, provided millions of jobs, and have been major players in global energy politics. Remember the ‘Black Gold’? Oil’s allure has been its dual role – both as a critical resource and a geopolitical tool.

Environmental Controversies:

Here’s the twist in the tale. While drilling companies have fueled our cars, heated our homes, and kept industries running, they’ve also faced criticism. From the Deepwater Horizon oil spill to fracking debates, the environmental impact of drilling operations has frequently been under the microscope.

Current Financial Standing:

Fast forward to today, with renewable energy sources becoming more accessible and affordable, the once-unchallenged reign of drilling companies is now facing competition. But let’s not write them off just yet. These companies still hold significant assets, knowledge, and infrastructure. They’re also showing adaptability, with some venturing into biofuels and other sustainable practices.

The Green New Deal’s Impact on Alternative Lending

Regulatory Changes:

The Green New Deal, while still a proposal, signals a strong intent from lawmakers to push for a greener economy. If implemented, drilling companies could see tighter regulations, potential sanctions, and increased operational costs. For alternative lenders, this translates to higher risks.

Investment Trends:

The winds of change have already started shifting investment patterns. With increasing focus on sustainable and responsible investing, alternative lenders are now more cautious. There’s a sentiment of hesitancy, as lenders grapple with the long-term viability of drilling companies in a Green New Deal world.

Sectoral Shifts:

But it’s not all gloomy. Some alternative lenders see this as an opportunity to diversify. By redirecting funds to cleaner energy sectors, they ensure their portfolios are aligned with future market trends.

With the Green New Deal, will Alternative Lenders Invest in Drilling Companies over the next 5 years?

This is the million-dollar question, isn’t it? Given the current momentum of environmental activism, public sentiment, and potential policy changes, the landscape for drilling companies looks challenging. However, business is about risk and reward. Some alternative lenders might see potential in companies that are adapting and evolving with the times. But one thing’s for sure, the days of unchecked investments in this sector are probably behind us.

Pros and Cons:

On the upside, drilling companies have infrastructure, experience, and deep market knowledge. They also have the potential to pivot to more sustainable operations. On the flip side, regulatory pressures, public sentiment, and competition from cleaner energy sources pose significant challenges.

Market Projections:

Forecasts suggest a mixed bag. While there’s expected to be a decline in traditional drilling operations, companies that diversify and innovate could still attract investments. For alternative lenders, the key would be to pick winners wisely.

Expert Opinions:

Leading financial analysts believe that while the drilling sector might face headwinds, it won’t vanish overnight. Investments will become more selective, focusing on companies that showcase adaptability, sustainability, and forward-thinking.

Financial Incentives and Disincentives

Tax Benefits:

Drilling companies have historically enjoyed tax benefits that incentivized investment. Who wouldn’t want a piece of that pie, right? Well, these goodies might face the chopping block if the Green New Deal or similar legislation gets the green light. Alternative lenders will have to factor in the potential loss of these incentives when making investment decisions.

Regulatory Costs:

Ah, the double-edged sword of regulation! While it can provide a framework for more responsible drilling, it also increases operational costs. Stricter environmental regulations could mean more expensive permits, higher-quality equipment, and greater liability. Alternative lenders would need to ponder whether the juice is worth the squeeze.

Risk Factors:

Beyond taxes and regulations, alternative lenders must consider the reputational risks of investing in drilling companies. With environmental consciousness on the rise, the optics of such an investment could be less than ideal. At the same time, the financial risk due to market volatility in the energy sector is another critical consideration. It’s not just about dollars and cents but public perception too.

The Alternative Energy Surge

Rise of Solar and Wind Energy:

Talk about a breath of fresh air! Renewable energy sources like solar and wind are becoming more efficient and cost-effective. Many states are making strides in shifting toward renewable power, which puts added pressure on traditional drilling companies. It’s not just about keeping up with the Joneses but staying ahead in the game.

Investment in Alternative Energy:

Here’s the catch—alternative lenders are not married to drilling companies. They’re in the game to make money, and if renewables offer a promising ROI, you bet they’ll jump ship. Investment trends are showing a tilt towards greener pastures, and this could further accelerate if the Green New Deal gains traction.

Competition with Drilling Companies:

Competition breeds innovation, but it also means thinner slices of the pie. With cleaner energy solutions competing for the same investment dollars, drilling companies will need to step up their game. Alternative lenders are likely to play the field, betting on multiple horses rather than going all-in on drilling.

Geopolitical Factors

Global Oil Politics:

Let’s not forget that the world runs on energy, and energy politics often dictate international relations. Major oil-producing regions wield significant geopolitical influence, and drilling companies have historically been entangled in this intricate web. Alternative lenders have to consider not just the local but the global playing field.

Energy Independence:

One of the rallying cries for drilling has been energy independence. The less reliant the U.S. is on foreign oil, the better, so the argument goes. But with renewables offering the same promise without the geopolitical entanglements, could the scales tip? It’s a question alternative lenders can’t afford to ignore.

Policy Shifts:

Ah, the whims of politics! With administrations changing every four to eight years, policies can shift dramatically. What’s favorable today might be taboo tomorrow. Alternative lenders need to be agile, adapting to the ever-changing policy landscape that could make or break their investments.

The Public Sentiment

The Rise of Environmental Consciousness:

The green wave isn’t just a fad—it’s a movement. From climate change protests to viral social media campaigns, public sentiment is increasingly eco-friendly. Alternative lenders are not operating in a vacuum; they’re part of this societal shift.

Social Media Campaigns:

Never underestimate the power of a hashtag! Social media campaigns like #StopDrilling or #GoGreen can rapidly shape public opinion and indirectly influence investor behavior. The digital age has made the court of public opinion more powerful than ever.

Investor Behavior:

At the end of the day, alternative lenders answer to their investors. If these stakeholders demand more responsible investment strategies, you can bet that’s what they’ll get. It’s not just about the bottom line but also about social responsibility and public perception.

Conclusion

The million-dollar question, “With the Green New Deal, will Alternative Lenders Invest in Drilling Companies over the next 5 years?” remains open-ended, largely because we’re in a period of transition. The landscape of energy is shifting, public sentiment is evolving, and legislation like the Green New Deal could throw a wrench in many existing investment strategies.

But here’s the kicker: The world of business thrives on risk and opportunity. While the future might not look as bright for drilling companies as it once did, it’s far from being a setting sun. For the savvy alternative lender, this could be a time for recalibration rather than retreat. It could be an era for diversification, hedging bets across the energy sector, both traditional and renewable. It’s not necessarily about jumping ship but perhaps steering it in a new direction.

So, as we keep an eye on the future, it’s clear that the decisions made by alternative lenders will be complex, multifaceted, and far from easy. They’ll be shaped by regulatory changes, public sentiment, market volatility, and a slew of other factors we’ve examined. These are interesting times, and they call for a keen sense of strategy, a touch of audacity, and a deep understanding of the broader picture.

In essence, the next five years could be a roller coaster ride for both drilling companies and alternative lenders. Buckle up; it’s going to be one heck of a journey.