by Carlos Perez | May 28, 2023 | TUPS News

Business owners in the U.S. are feeling the pressure of the debt-ceiling deal that is starting to take shape. With the proposed economic changes, it’s important for business owners to have access to capital to stay afloat. Fortunately, there are several...

by Carlos Perez | May 22, 2023 | Business Finanace

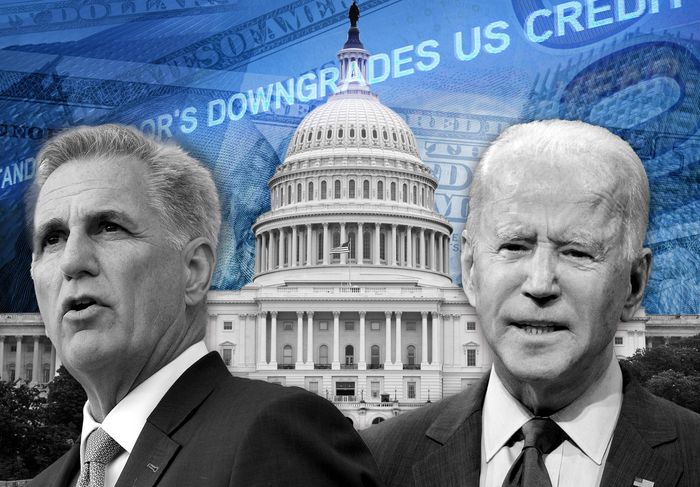

As debt-ceiling talks stall, causing uncertainty in traditional financial markets, alternative lenders are stepping up to fill the gap, particularly for small business owners. Here’s a look at how they are doing it: Leveraging Fintech Solutions: In these times...

by Carlos Perez | May 14, 2023 | Business Finanace

If the U.S. risks breaching its debt ceiling in June, it means that unless Congress raises the limit on how much debt the country can have, the U.S. government could default on its obligations. This would have serious implications for the U.S. and global economy. When...

by Carlos Perez | May 9, 2023 | Small Business Tips

When a bank raises its prime rate, it can have a significant impact on small business loans, especially when it comes to term loans. If you are a small business owner, here are some steps you can take to manage the situation: Assess your current financial situation:...

by Carlos Perez | May 3, 2023 | Term Loans

Deciding between a business loan and a personal loan for your business depends on several factors, including the purpose of the loan, your credit history, your business’s financial health, and the available loan terms. Here are the key differences between the...